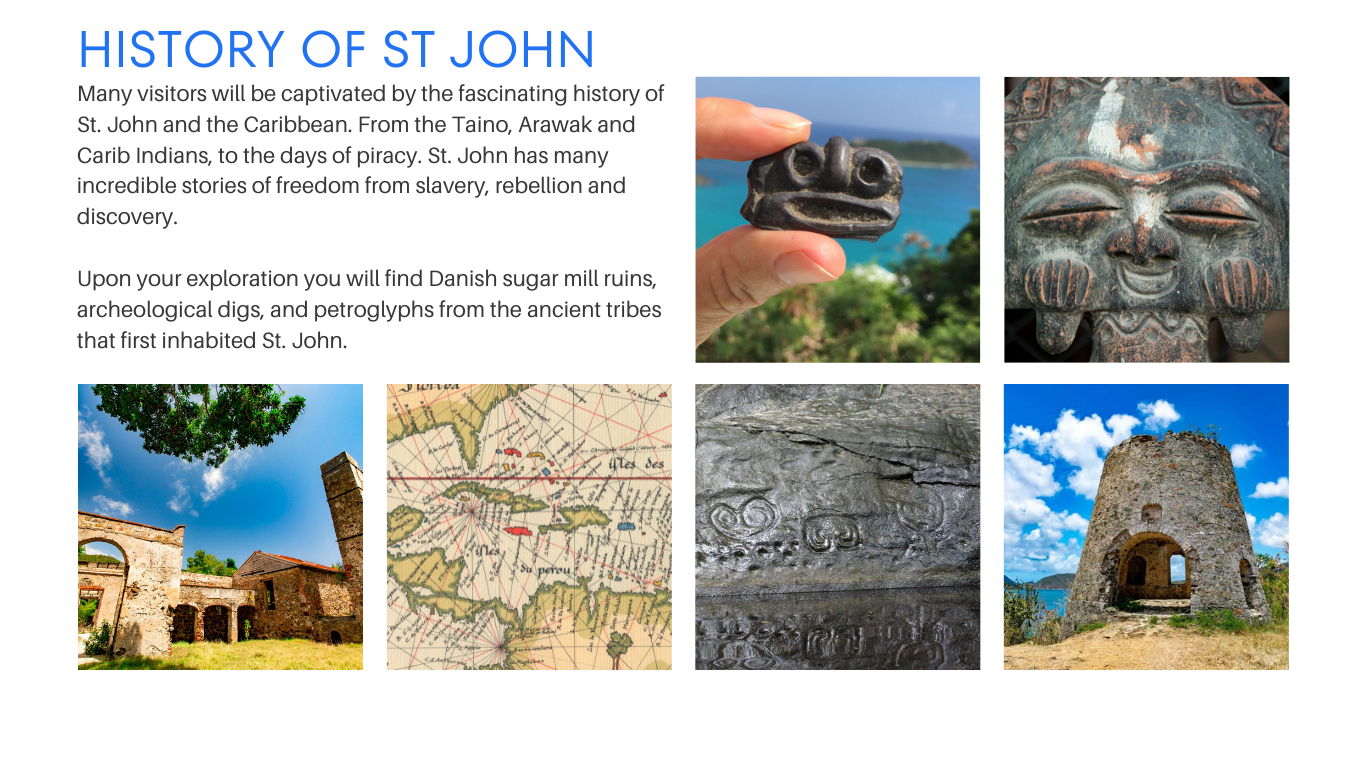

Evidence of tribal inhabitants date back to the 700’s AD, although there may have been people here before that and ran until the late 1400’s when western colonization began. The Virgin Islands tumultuous history saw 6 different nations possessing the islands until the U. S. Government purchased St. John from Denmark in 1917. During that time in 1733, one of the most successful slave rebellions in history left St John under african slave control for several months. A Naval governor ruled until 1931 when the U.S. Dept. of the Interior assumed control. We are an unincorporated territory. Residents of the Virgin Islands vote for a local Governor. We cannot vote for the President of the United States.However, we do receive all other benefits awarded to Citizens of the (mainland) United States. For more info and deeper reading check out https://stjohnhistoricalsociety.org/

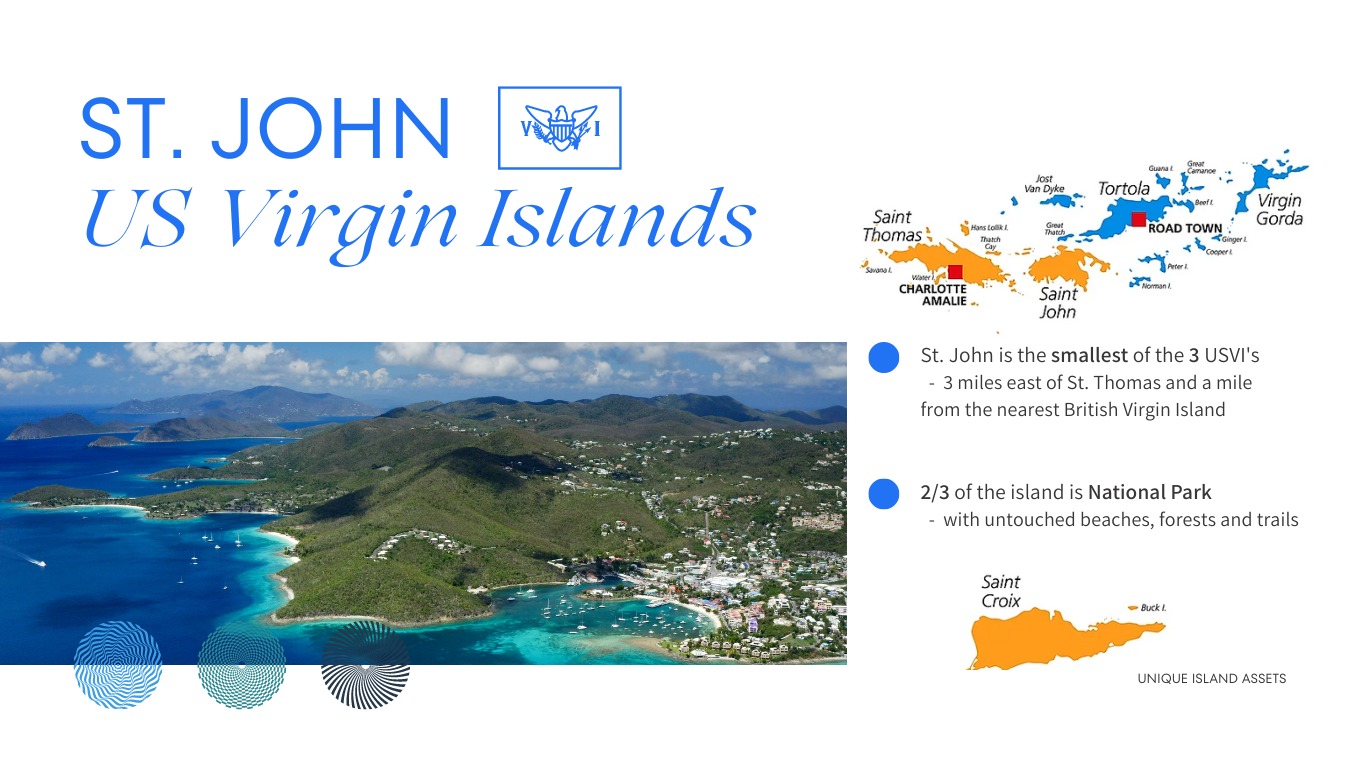

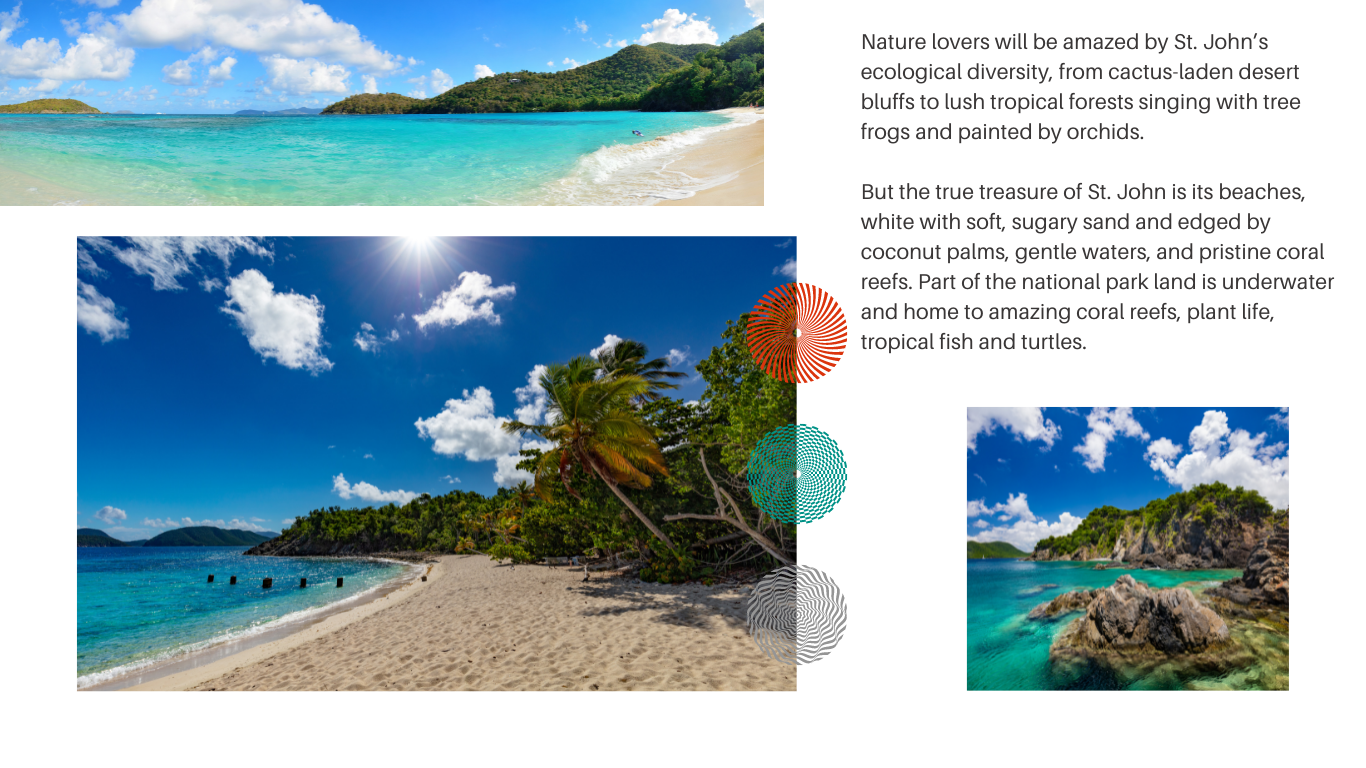

The still-pristine island of St. John is the smallest of the three U.S. Virgin Islands and lies just 3 miles east of St. Thomas and a mile from the nearest of the British Virgin Islands. Nearly two-thirds of the island is National Park with untouched beaches, forests and nature trails for your enjoyment. Nature lovers will be amazed by St. John’s ecological diversity, from cactus-laden desert bluffs to lush tropical forests singing with tree frogs and painted by orchids.

The true treasure of St. John is its beaches, white with soft, sugary sand and edged by coconut palms,gentle waters, and pristine coral reefs. World-famous Trunk Bay is here, as are spectacular Hawksnest Bay and Cinnamon Bay. Part of the national park land is underwater and home to amazing coral reefs,plant life, tropical fish and turtles.

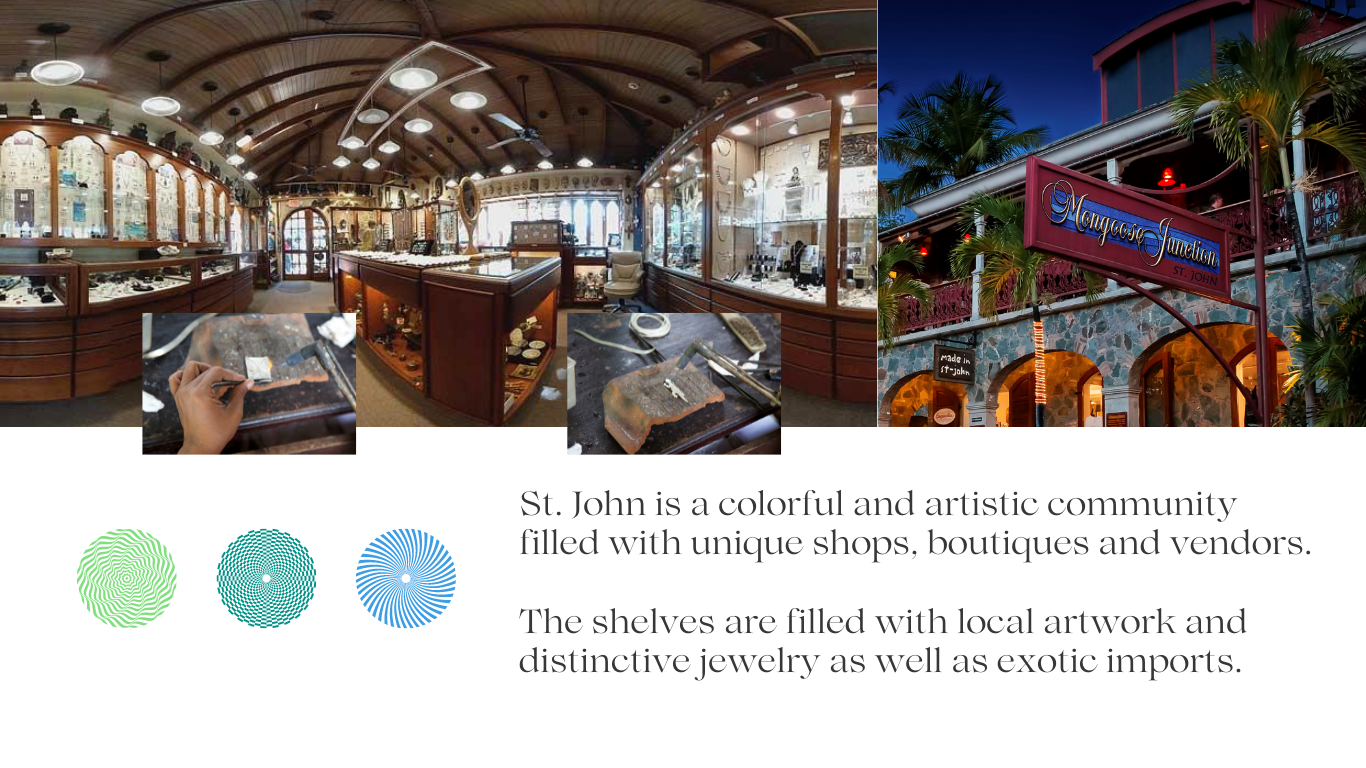

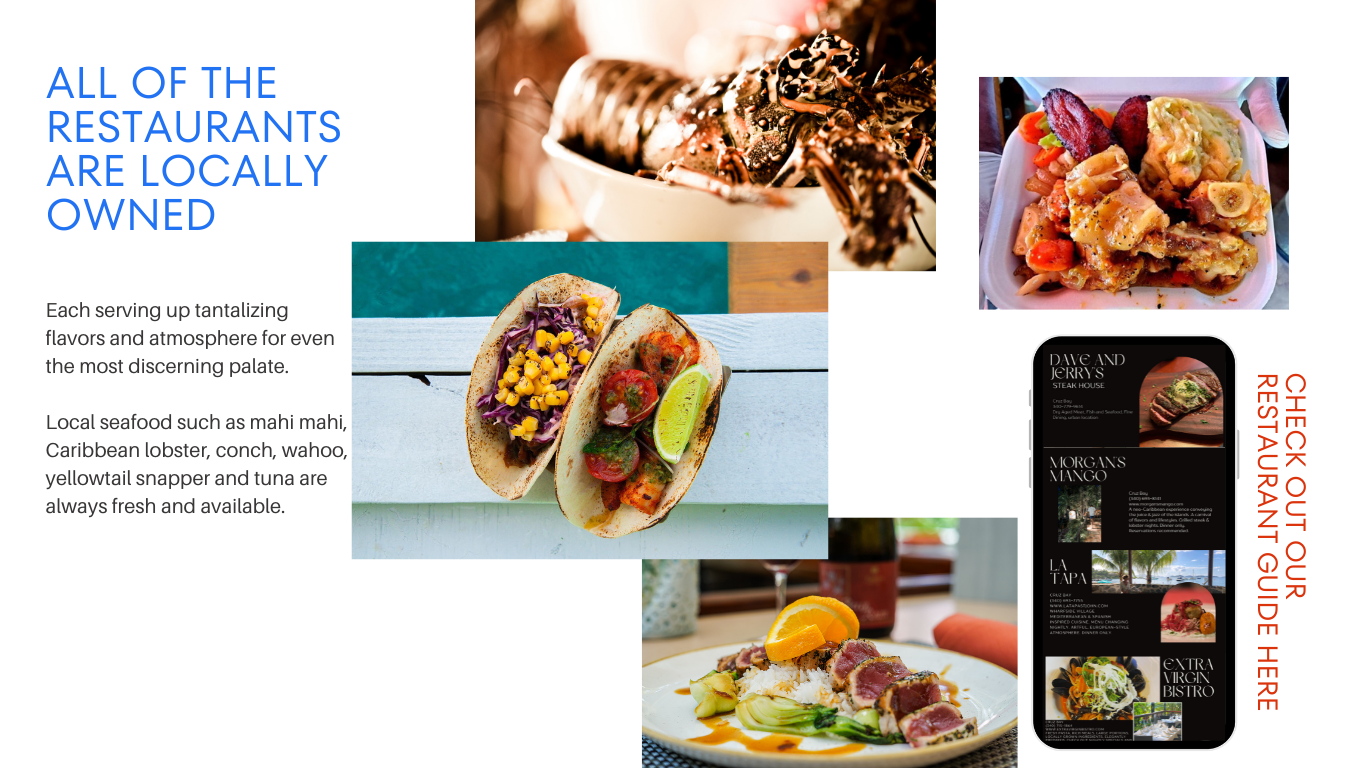

Beyond the spectacular natural beauty, St. John is a colorful and artistic community filled with unique shops, boutiques and vendors. The shelves are filled with local artwork and distinctive jewelry as well as exotic imports. All of the restaurants are locally owned, each serving up tantalizing flavors and atmosphere for even the most discerning palate. Local seafood such as mahi mahi, Caribbean lobster, conch, wahoo, yellowtail snapper and tuna are always fresh and available. Many visitors will be captivated by the fascinating history of St. John and the Caribbean. From the Taino, Arawak and Carib Indians, to the days of piracy, to the Danish sugar plantations, St. John has amazing stories of slavery and freedom, rebellion and discovery. Many remnants of those days have been preserved here. Upon your exploration you will find Danish sugar mill ruins, archeological digs,and petroglyphs from the ancient tribes that first inhabited St. John.

CLICK HERE FOR OUR restaurant guide or BEACH GUIDE

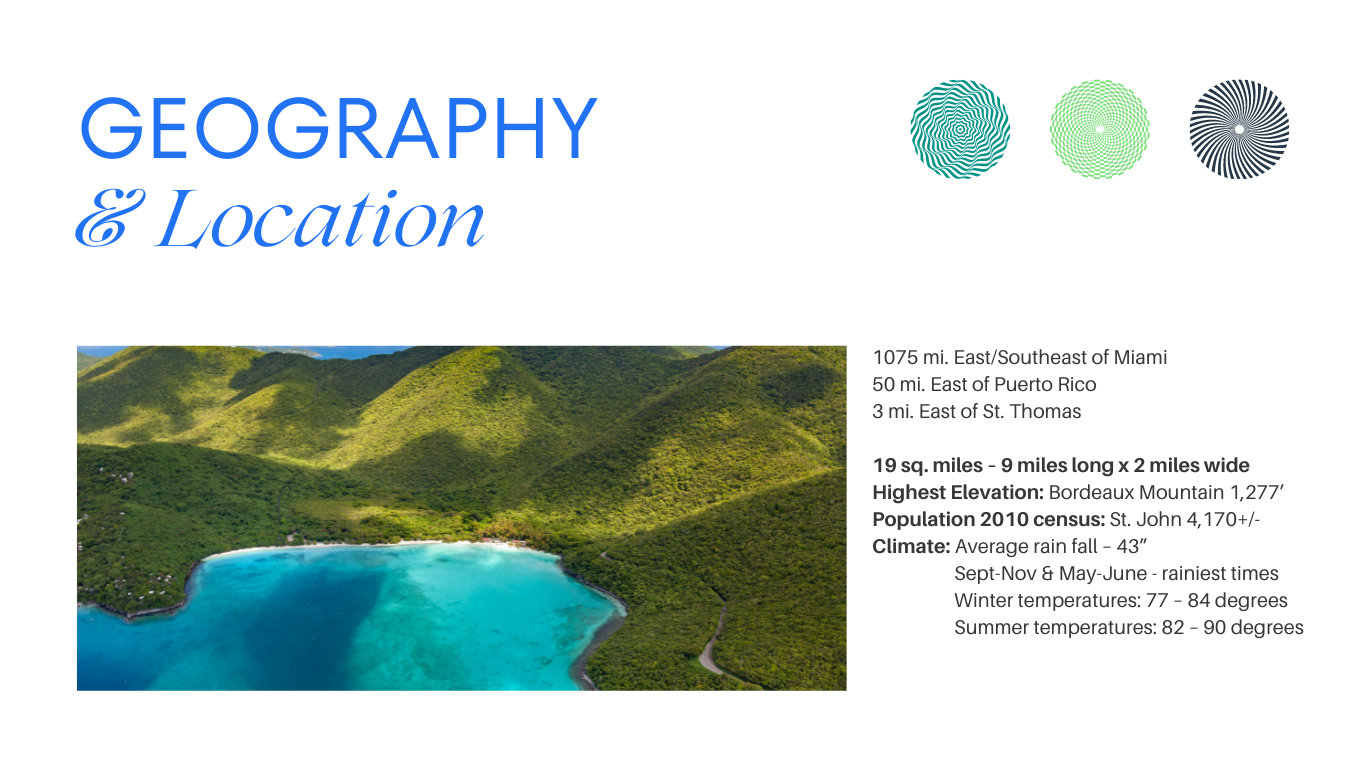

GEOGRAPHY and LOCATION of St John

1075 mi. East/Southeast of Miami

50 mi. East of Puerto Rico

3 mi. East of St. Thomas

St. John is 19 sq. miles – 9 miles long x 2 miles wide

Highest Elevation: Bordeaux Mountain 1,277’

Population 2010 census: St. John 4,170+/- / St. Thomas – 51,634+/-

Climate: Average rain fall – 43” Sept-Nov & May-June tend to be the rainiest times

Winter temperatures – 77 – 84 degrees

Summer temperatures – 82 – 90 degrees

CUSTOMS and IMMIGRATION on St John

Being a Territory of the United States, U.S. residents DO NOT need a passport to travel to the US Virgin Islands. U.S. residents, including children, may send or carry up to $1,200 of duty-free merchandise every 30 days from the U.S. Virgin Islands. If you go over the $1,200 allowance,your Virgin Islands purchases are taxed at a flat rate of 5% on the next $1,000, and 6.5% after that,depending on the type of goods.

You can also send as many gifts as you want to friends and relatives-but no more than one per day-spending up to $100 each. These do not have to be declared in your exemption. U.S. residents over 21 can return to the United States with 5 bottles of liquor duty free. You are allowed 6 bottles if one is locally bottled. All island-made goods are duty-free and do not count toward your exemption.

Call the Bureau of Customs at (340) 774-5539.

BUILDING ON ST JOHN

Virgin Islands zoning, building & housing laws & regulations may be obtained from the Office of the Lieutenant Governor, accounting section, 18 Kongens Gade, St. Thomas 00802, (340) 774-2991.

Building specifications can be obtained from the Department of Planning and Natural Resources(DPNR) (340) 774-3320 on St. Thomas and (340) 693-8735 on St. John. Website www.dpnr.gov.vi

Masonry construction costs are approximately $600-$800/per square foot.

ECONOMIC DEVELOPMENT COMMISSION

The Virgin Islands has a unique program to encourage and retain business investment in the territory-the Economic Development Commission. Simply, the Virgin Islands are allowed to give certain tax breaks to businesses that comply with specific rules and

guidelines. The EDC program grants long-term tax exemptions in exchange for investment in the territory.

Ask us for a brief summary of Eligible Businesses and Requirements for Granting Benefits and how your company can apply for 100% Exemption from the following taxes;

Real Property Taxes on real property used in business

Gross Receipts Taxes (tax on gross revenue)

Excise Tax on building materials, tools, etc used in construction, alteration, reconstruction or extension of business premises.And Reduction of tax liability as follows;

90% on income taxes on qualified business income

1% Customs Duty on raw materials and component parts used in industrial and manufacturing processing.

INSURANCE on St John

Although not required, title insurance is available and recommended. Full Homeowner’s insurance coverage including Windstorm/Earthquake insurance is about 2%-3% of replacement value for masonry/stone (wood frame may be higher).

MAIL SERVICE ON ST JOHN

U S Postal Service, DHL, UPS, Sprint Courier, Federal Express

MEDICAL SERVICES On St John

St. John: Myrah Keating Heath Clinic 340-693-8900

St. Thomas: Roy L. Schneider Hospital 340-776-3497

Myrah Keating-Smith Clinic on St. John plus several private physicians.

Roy L. Schneider Hospital

Denyce Singleton, director

Yvette Canegata, associate director

MORTGAGES ON ST JOHN

Mortgages are available through banks and lending institutions, including First Bank, Bank of Nova Scotia and Merrill Lynch. Most banks require the Buyer to pay for a title search, title insurance, property appraisal, surveyor’s certificate and report, survey and bank attorney fees. Second home buyers can qualify for at least 70% loan to value mortgages and some sellers will offer owner financing. We will gladly prepare an amortization schedule for you.

SCHOOLS On St John

St. John:

Coral Bay to 6th grade (public)

Cruz Bay to 9th grade (public)

The St. John School on Gifft Hill Pre K to 12th grade (private)

The St. John Christian Academy K – 3rd grade (private)

St. John School of the Arts

St. John Montessori School-2.5 to 8 years old

St. Thomas:

2 private schools & 7 religious affiliated schools

Antilles School – Pre K – 12th grade (private)

University of the Virgin Islands-175 acre campus offering both bachelor & master degree

programs

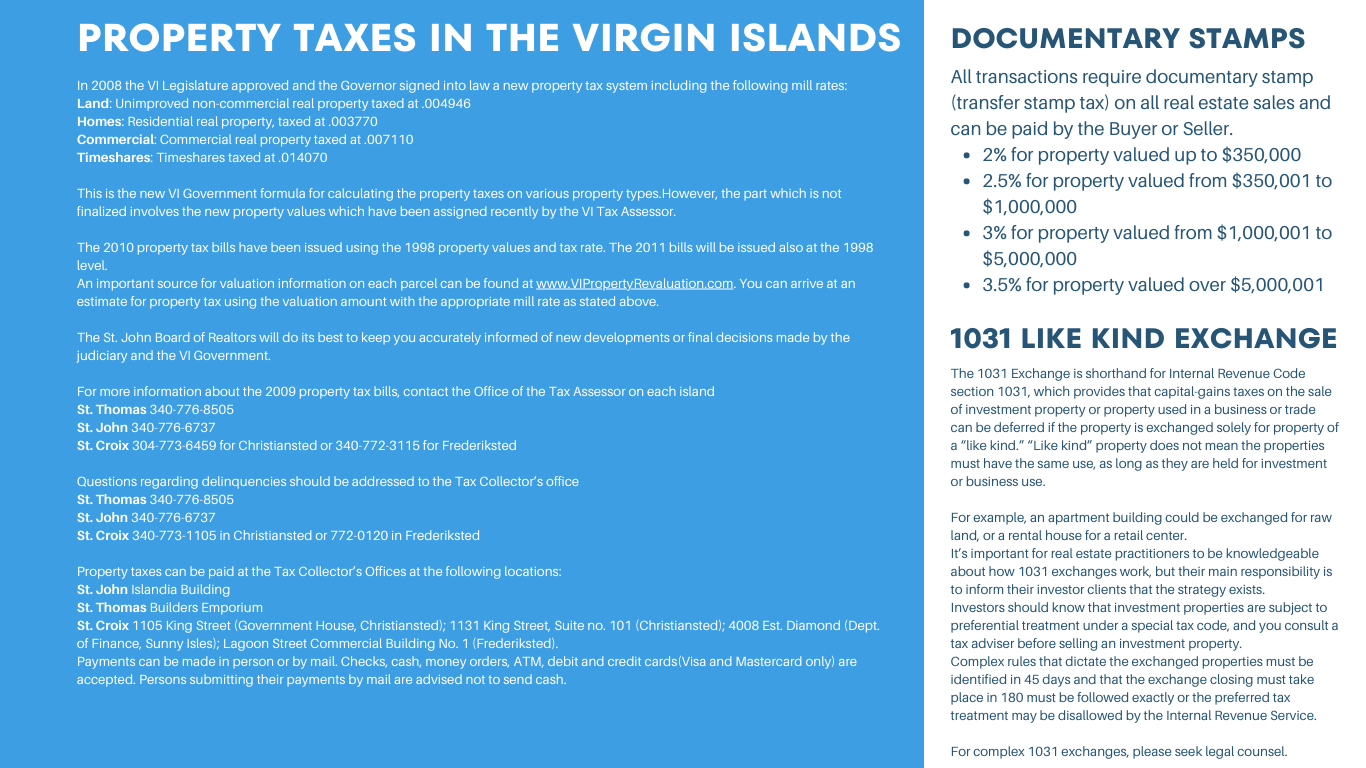

PROPERTY TAXES IN THE Virgin Islands

PROPERTY TAXES:

In 2008 the VI Legislature approved and the Governor signed into law a new property tax systemincluding the following mill rates:

Land: Unimproved non-commercial real property taxed at .004946

Homes: Residential real property, taxed at .003770

Commercial: Commercial real property taxed at .007110

Timeshares: Timeshares taxed at .014070

This is the new VI Government formula for calculating the property taxes on various property types.However, the part which is not finalized involves the new property values which have been assigned recently by the VI Tax Assessor.

The 2010 property tax bills have been issued using the 1998 property values and tax rate. The 2011 bills will be issued also at the 1998 level.

An important source for valuation information on each parcel can be found at www.VIPropertyRevaluation.com. You can arrive at an estimate for property tax using the valuation amount with the appropriate mill rate as stated above.

The SJBOR will do its best to keep you accurately informed of new developments or final decisions made by the judiciary and the VI Government.

For more information about the 2009 property tax bills, contact the Office of the Tax Assessor on each island at 776-8505 on St. Thomas, 776-6737 on St. John and on St. Croix at 773-6459 for Christiansted or 772-3115 for the Frederiksted office. Questions regarding delinquencies should be addressed to the Tax Collector’s office at (340)776-8505 on St. Thomas, 776-6737 on St. John, 773-1105 in Christiansted or 772-0120 at the Frederiksted Office.Property taxes can be paid at the Tax Collector’s Offices at the following locations:

St. John: Islandia Building;

St. Thomas: Builders Emporium;

St. Croix: 1105 King Street (Government House, Christiansted); 1131 King Street, Suite no. 101 (Christiansted); 4008 Est. Diamond (Dept. of Finance, Sunny Isles); Lagoon Street Commercial Building No. 1 (Frederiksted).

Payments can be made in person or by mail. Checks, cash, money orders, ATM, debit and credit cards(Visa and Mastercard only) are accepted. Persons submitting their payments by mail are advised not to send cash.

INCOME TAXES on St John

Income Taxes are the same as U.S. Federal taxes. No state or city taxes.

GROSS RECEIPTS TAX on St John

Businesses pay 5% gross receipts tax on gross money earned from all transactions including services. Monthly exemption is $9,000 for taxpayers with gross receipts of less than $225,000.

DOCUMENTARY STAMPS For Buying Real Estate in the Virgin Islands

All transactions require documentary stamp (transfer stamp tax) on all real estate sales and can be paid by the Buyer or Seller.

2% for property valued up to $350,000

2.5% for property valued from $350,001 to $1,000,000

3% for property valued from $1,000,001 to $5,000,000

3.5% for property valued over $5,000,001

1031 LIKE KIND EXCHANGE On St John

The tax benefits of 1031 Exchanges provide tremendous flexibility and encourage investment growth.

The 1031 Exchange is shorthand for Internal Revenue Code section 1031, which provides that capital-gains taxes on the sale of investment property or property used in a business or trade can be deferred if the property is exchanged solely for property of a “like kind.” “Like kind” property does not mean the properties must have the same use, as long as they are held for investment or business use.For example, an apartment building could be exchanged for raw land, or a rental house for a retail center.

It’s important for real estate practitioners to be knowledgeable about how 1031 exchanges work, but their main responsibility is to inform their investor clients that the strategy exists.

Investors should know that investment properties are subject to preferential treatment under a special tax code, and you consult a tax adviser before selling an investment property. Complex rules that dictate the exchanged properties must be identified in 45 days and that the exchange closing must take place in 180 must be followed exactly or the preferred tax treatment may be disallowed by the Internal Revenue Service. For complex 1031 exchanges, please seek legal counsel.

TELECOMMUNICATIONS

Internet connection through DSL, Broadband, Wireless & Satellite services. There are numerous cybercafes and the St. John Library offering internet access. Cellular phone service is available through AT&T, Innovative Wireless, Sprint, Verizon.

Local telephone service is provided by Innovative Telephone. The St. John office is located on the 2ndfloor at The Marketplace. (340) 779-9999

US VIRGIN ISLANDS NATIONAL PARK

In 1950 Mr. Lawrence Rockefeller purchased extensive holdings on St. John from the Danish WestI ndies Company, developed Caneel Bay Resort and donated remaining acreage to the U.S. Government as public park and Congress formed the VI National Park.

The Virgin Islands National Park is 7200 acres of land plus 5650 acres of underwater holdings

https://www.nps.gov/viis/index.htm

UTILITIES On St John

Electric is supplied by underwater cable from St. Thomas with a back-up generator on St. John. WAPA(Water and Power Authority) office is located on the 3rd floor of The Marketplace, (340) 776-6446,Mon-Fri.

Cable TV service is provided by Innovative Cable TV. The office is located on the 2nd floor of The Marketplace. (340) 693-8685.

Rain water is collected from the roof and stored in cisterns. Water is available for purchase from the desalination plant at a cost of about $365 for 4,200 gallons or about 8.7 cents a gallon.

Required cistern capacity is 10 gallons of cistern storage for every square foot of roof on single story home, 15 gallons for a 2-story home.

Propane gas is available for home delivery by Paradise Gas. A 100lb tank is $105. Small BBQ tanks can be dropped off and refilled. (340) 693-8848

ORGANIZATIONS on St John

AARP (territorywide)PO Box 1599 Kingshill

St. Croix VI 00851

Tel. 719-2277 / fax 692-2544

Web site: www.aarp.org/vi

American Legion

Viggo E. Sewer Post 131

P.O. Box 37

St John, VI 00831

Elmo L. Rabsatt Sr, commander 693-8557 or 344-4878

Paul Devine, adjutant 998-1925

Coral Bay Yacht Club

9901 Estate Emmaus

St. John, VI 00830

Tel. 513-4523

e-mail: studioequinox@earthlink.net

Dave Conro, Commodore

Chris Schatzman, media relations

The Yacht Clubs meets at 6:30 p.m. the first Wednesday of each month at Skinny Legs in Coral Bay onSt. John.

Cruz Bay Revitalization Project

50000-4A Estate Enighed #250

St. John VI 00830

Tel. 715-0150 / fax 715-0150

D.C. Metro Virgin Islands Association

PO Box 75903

Washington, DC 20013

e-mail: viadcmetro@yahoo.com

www.dcmetrovia.com

Lo’an Sewer, vice president

Epiphany Theater CompanyP.O. Box 37

St John, VI 00831

Paul Devine, Managing Director 998-1925

Carol DeSenne, Director of Public Relations 643-4838

Friends of the Elaine I Sprauve Library

PO Box 30

St. John, VI 00831

Tel. 776-6901

Friends of the National Park

P.O. Box 811

St. John, VI 00831

Office in Mongoose Junction

Tel. 779-4940

Fax 693-9973

e-mail: info@friendsvinp.org

www.friendsvinp.org

Gateway Community Planning Committee

Raphael Wesselhoft

Tel. 776-6317

Girl Scout Council of the US Virgin Islands

PO Box 761

St. Thomas VI 00804-0761

Tel. 774-1054 / Fax 779-7223

e-mail: girlscoutsusvi@earthlink.net

Jacqueline A. Dennis, board president

Violet Anne Golden, management consultant

Love City Pan Dragons Youth Steel Orchestra

PO Box 1537

St. John VI 00831

e-mail: pandragons@unitedstates.vi

Web site: www.pandragons.org

Tel. 776-6484

Fax 693-8807

Corine Matthias, President

Navy League of the United States

St. Thomas/St. John Council

P.O. Box 7663

St. Thomas, VI 00801

Tel. 776-3650 ext. 16 or 776-0241

Fax 774-1050

e-mail: thoffman@islands.vi

Web site (local): www.vinavyleague.org

Web site (national): www.navyleague.org

Thomas W. Hoffman, national director

St. John Business and Professional Women

St. John Community Foundation

St. John EMS Association

14 Spring Garden

St. John, U.S.V.I. 00830

Tel. 693-5461 or 776-6222

Carol Beckowitz, President

St. John Lions Club

St John Rescue Inc.

PO Box 1225

St John, VI 00831

Contact:

John Bowman, Chief

774-8513 or 643-3831

Web site: www.StJohnRescue.org

Rotary Club of St. John

Westin Resort, Great Cruz Bay

St. John 00830

Fax 779-4752

Dave Carlson, president

John Fuller, secretary

People Moving Forward Tel. 779-4585

St. John School of the Arts

Tel. 779-4322

Ruth “Sis” Frank, director

St. John Recreation Association Tel. 693-5220

Virgin Islands Charteryacht League

3801 Crown Bay, Suite 204-